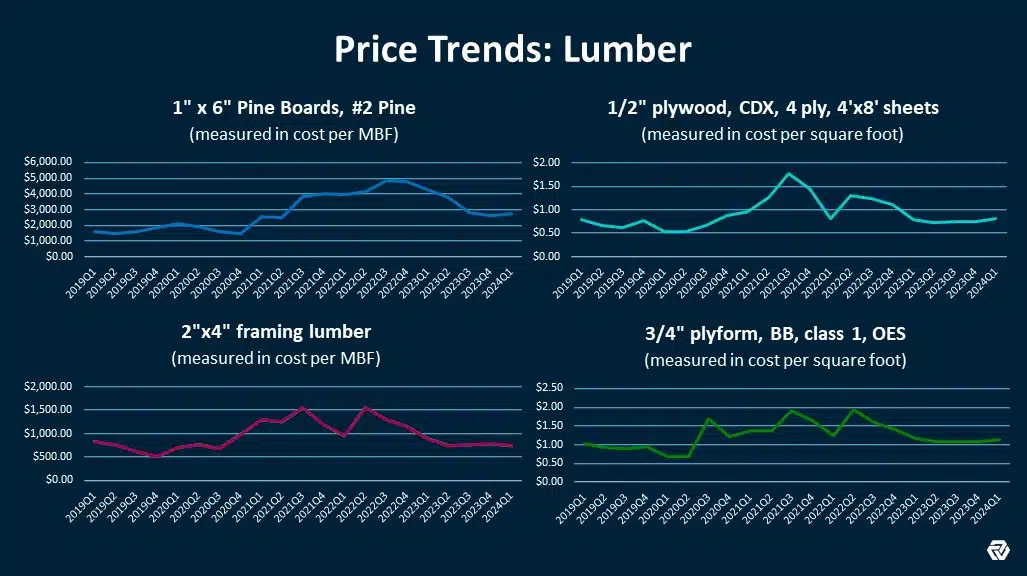

What the Data Says: Lumber Price Updates

Gordian’s RSMeans Data is North America’s most comprehensive, and most trusted, construction cost database. Containing upwards of 92,000 construction material, labor and equipment costs, RSMeans Data is prized by architects, engineers and contractors for accurate and current prices.

Regular, comprehensive updates to the database make it a reliable resource for construction professionals. They also empower Gordian’s internal team of data analysts and cost engineers to track long-term price trends, providing industry executives and leaders with insights they can use to weather cost volatility, stay ahead of the curve and make more informed business decisions.

In this blog post, we’ll use RSMeans Data to provide a quarterly analysis of the price of lumber, one of the construction sector’s most vital materials.

DISCLAIMER: The prices referenced below represent the national average and are used for reference purposes only. Costs in your local market may differ.

Tracking the Price of Lumber With RSMeans Data

January 2024

Framing lumber prices sink to their lowest point since the summer of 2020. However, North American wildfires threaten to reverse the trend. When Canadian wildfires intensified in June of 2023, the cost of lumber climbed temporarily. History may repeat itself.

November 2023

Lumber prices stabilize in the second half of the year following their 2022 highs. This decrease is driven primarily by the dropping cost of wood framing, which dips almost 11% thanks in part to declining residential home construction. Conversely, prices rebound in many other lumber categories, finishing the year on a modest uptick. RSMeans Data shows lumber costs falling an average of 2.4% heading into 2024, but a historic wildfire season, coupled with curtailments by major suppliers, may signal future increases in lumber costs.

Get analysis and commentary on construction material prices and labor costs, including quarterly reports, in this resource hub.

July 2023

Lumber prices continue a downward slide from their 2020 peaks and are primed to hit pre-pandemic levels in most of the U.S. by the end of the year. But it’s not all good news. Gordian anticipates higher prices in 2024 because of natural disasters and supply-side volatility.

January 2023

North American lumber prices, after peaking in mid-2022, begin descending, yet they hold above the pre-pandemic baseline. The once-steady market, characterized by relative predictability, now contends with a startling new element: price volatility.

The pandemic’s onset disrupts production, ignites a wave of DIY home projects and stokes a robust housing market, thanks to historically low interest rates. Consequently, lumber costs surge, at one point rising more than 200% above pre-pandemic levels.

Rising interest rates temper the housing market fervor, prompting a decline in the cost of lumber. The price of framing lumber falls by 42%, only to be outpaced by plywood, which has dropped 55% since its peak in 2021. The cost of pine boards retracts by 10% following a 225% climb over the course of two years. Industry experts caution vigilance as the lumber market continues its recalibration.

January 2022

The price of CDX plywood dives 24% after reaching an unsustainable high in the summer of 2021. The cost of standard, construction-grade lumber dips by 6%, a significant price swing for a material used extensively in the residential building market.

April 2021

Framing lumber prices soar, rising 162% since Q4 of 2019, with the COVID-19 pandemic playing a significant role in the increase. The National Association of Home Builders notes these prices are adding an estimated $24,000 to new single-family homes. Although less impactful on commercial construction, engineers report widespread lumber cost fluctuations. Plywood and pine boards are not spared, with the cost of ½ inch plywood sheets up 137% since 2020 and pine boards increasing 65% over two years. Gordian’s cost experts anticipate the price of both materials will continue trending upward.