What the Data Says: Insulation Cost Updates

Gordian’s RSMeans Data is North America’s most comprehensive, and most trusted, construction cost database. Containing upwards of 92,000 construction material, labor and equipment costs, RSMeans Data is prized by architects, engineers and contractors for accurate and current prices.

Regular, comprehensive updates to the database make it a reliable resource for construction professionals. They also empower Gordian’s internal team of data analysts and cost engineers to track long-term price trends, providing industry executives and leaders with insights they can use to weather cost volatility, stay ahead of the curve and make more informed business decisions.

In this blog post, we’ll use RSMeans Data to provide a quarterly analysis of the price of insulation and other common interior finishes, including flooring, carpet, paint and gypsum wallboard.

DISCLAIMER: The costs referenced below represent the national average and are used for reference purposes only. Costs in your local market may differ.

Tracking Insulation Price With RSMeans Data

April 2024

Drywall costs increased in many regions of the country after a long dip. A major reason for the cost rebound is a spike in the price of fuel. Drywall is a heavy material with slim profit margins, but since the cost to transport it increased, the material cost increased accordingly.

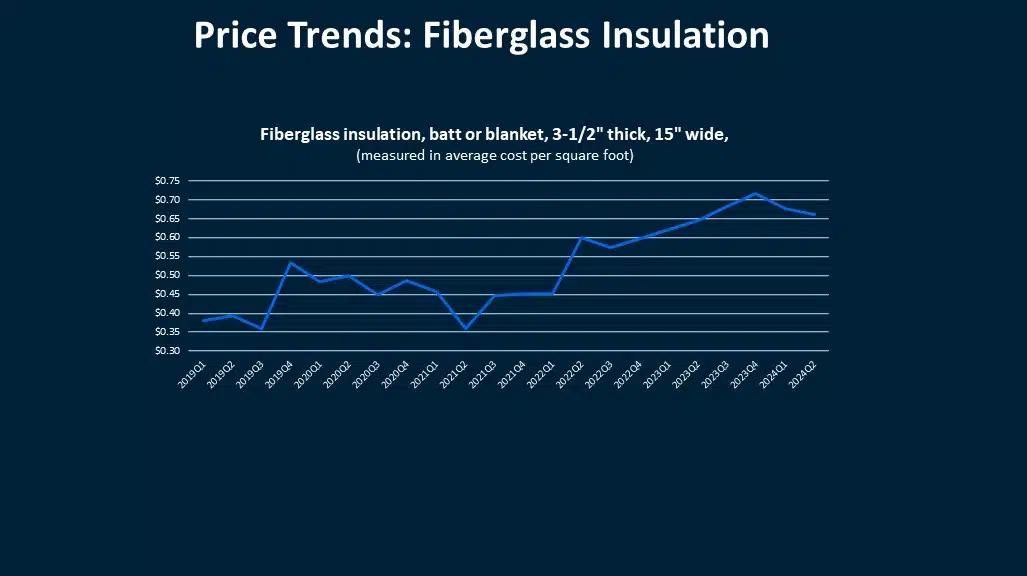

Conflicting market trends are muddying the picture when it comes to fiberglass insulation costs. While we have nothing definitive to report at this time, our cost experts will continue examining RSMeans Data to see if a long-term outlook emerges.

January 2024

The price of fiberglass insulation continues its steady upward trend and the wind is still at its back. Looking at interior finishes, drywall costs are on a prolonged six-month slide, with the price per square foot declining 11% from their peak last summer.

November 2023

Fiberglass insulation and gypsum board costs continue an escalation that began in 2021. Gordian’s experts anticipate further volatility in the gypsum market due to supply-side concerns.

Average interior construction costs rise 6.8% year-over-year. Painting costs lead the way, up approximately 10% over that span. Gypsum board is up about 8%. The price of flooring and other finishing materials stabilizes relative to the last few years. There is optimism that this calm will continue into 2024, however, lagging demand due to a weak residential construction market may have an impact.

Get analysis and commentary on construction material prices and labor costs, including quarterly reports, in this resource hub.

July 2023

On average, insulation costs are nearly 25% higher than they were in Q3 of 2022. A primary reason for the increase is rising insulation input prices, particularly mineral wool, which have climbed for two years and show no signs of regression. Gordian analysts foresee continued incremental increases in the cost of fiberglass and other insulation materials through the back half of 2023.

January 2023

Insulation costs tick up 11% on average, driven by roofing and waterproofing cost spikes. Reports of increased supply in the second half of the year suggest that insulation prices may dip. Yet, there is some concern that rising input costs, the cost of natural gas, for example, may sustain higher prices for the first six months of 2023.

January 2022

The cost of hollow metal doors leaps by 33% compared to its 2021 average. This whiplash is a result of higher steel prices.