Executive Summary

As 2024 draws to a close, the U.S. construction industry finds itself navigating stabilized material prices alongside persistent challenges tied to inflation, labor shortages and high interest rates. Insights from Adam Raimond, Program Manager – Construction Indices at Gordian; Courtney Davis, Supply Chain Analyst at Gilbane Building Company; and Ryan Martorano, Chief Estimator, and Mark Rothman, Corporate Director of Design and Sustainability from Hensel Phelps, reveal a complex market landscape. While certain materials have shown price relief, ongoing pressures on infrastructure and supply chain vulnerabilities underscore a cautious outlook for 2025. Broader data from the Associated General Contractors of America (AGC), American Institute of Architects (AIA) and the U.S. Bureau of Labor Statistics (BLS) add further context, projecting both stability and volatility as the industry approaches the new year.

Building Models Used To Calculate Price Data

Gordian’s data team researches material, labor and equipment prices and quantities in cities across the U.S. and Canada to create a composite cost model, which is weighted to reflect actual usage in the building construction industry.

To capture the types of construction activity typically performed across North America, researchers merged nine building types, which represent those most commonly found across America and Canada. They are:

1. FACTORY (one story)

2. OFFICE (two to four stories)

3. STORE (retail)

4. TOWN HALL (two to three stories)

5. HIGH SCHOOL (two to three stories)

6. HOSPITAL (four to eight stories)

7. GARAGE (parking)

8. APARTMENT (one to three stories)

9. HOTEL/MOTEL (two to three stories)

Adam Raimond at Gordian describes the Q4 2024 market as one of “fluctuating material prices” that, although stabilized after recent peaks, continues to respond to variable demand and supply conditions. Raimond notes a steady decline in structural steel prices as demand wanes. He observes that while plywood and plyform costs dropped significantly over the last quarter, framing lumber prices overall remain well below their 2022 highs. Copper electric wire demand is rising, which could create future supply constraints as copper usage increases across projects.

Recent AGC data corroborates these trends, highlighting robust public infrastructure spending, especially in transportation and water sectors, while growth in private sectors such as retail and lodging has moderated.

Courtney Davis at Gilbane reports revised forecasts for copper and conduit prices due to rising global demand. Steel prices are expected to remain low, but framing lumber costs may increase slightly as suppliers manage limited production to balance weak demand. Ryan Martorano and Mark Rothman from Hensel Phelps similarly note that concrete block and structural steel are impacted not only by regional demand but also by increased tariffs and energy costs, which continue to pose procurement challenges.

The fourth quarter reflects a blend of global economic events and regulatory pressures expected to shape supply chain dynamics into early 2025. Davis notes that China’s recent stimulus measures have ramped up demand for materials like copper, sustaining pressure on global supply chains. This increased demand, combined with elevated shipping and import costs, could continue driving price volatility for critical construction materials, particularly copper and steel.

Raimond highlights the impact of environmental events, such as Hurricanes Helene and Milton, which disrupted transportation routes and manufacturing hubs, especially around North Carolina. These disruptions affected the availability of materials like steel and drywall and created challenges in labor and equipment availability, contributing to regional cost fluctuations and extended project timelines.

How National Average Material Costs Are Determined

Gordian’s team contacts manufacturers, dealers, distributors and contractors all across the U.S. and Canada to determine national average material costs. Included within material costs are fasteners for a normal installation. Gordian’s engineers use manufacturers’ recommendations, written specifications and/or standard construction practice for size and spacing of fasteners. The manufacturer’s warranty is assumed. Extended warranties and sales tax are not included in the material costs.

Note: Adjustments to material costs may be required for your specific application or location. If you have access to current material costs for your specific location, you may wish to make adjustments to reflect differences from the national average.

Davis also highlights the impact of regulatory changes, such as the EPA’s AIM Act, set to phase out R-410 refrigerant-based HVAC systems by 2025. Contractors will need to budget for increased costs tied to A2L refrigerants, which require new, retrofitted systems incompatible with R-410 setups. Currently, these A2L systems carry a 2-5% higher cost, underscoring the importance of forward planning to mitigate budget impacts.

Experts Ryan Martorano and Mark Rothman from Hensel Phelps emphasize the influence of geopolitical tensions in material-rich regions, such as the Middle East and Eastern Europe, where instability can disrupt the supply of essential materials like steel and copper. They also underscore the risks posed by natural disasters, noting that the Southeastern U.S. — a major manufacturing hub — is particularly vulnerable to extreme weather events. The hurricanes in Q4 disrupted transportation and production for key materials like steel and concrete. With domestic manufacturing heavily concentrated in this region, this lack of geographic diversity increases the risk of prolonged supply chain disruptions during future climate events.

Labor shortages continue to be a critical constraint, impacting both project costs and timelines. According to BLS data, while construction employment remains robust, a shortage of skilled labor is pushing wages higher, a trend expected to intensify as recent interest rate cuts stimulate project demand into 2025. Davis suggests that wage stability may shift in early 2025, particularly in regions benefiting from increased public infrastructure investments, which could further affect material costs. Additionally, Raimond points out notable regional differences in framing lumber costs, which tend to be lower in the Midwest due to the area’s timber species, proximity to Canadian suppliers and regional construction activity.1

In response to persistent pressures, both Gordian and Gilbane report an increase in supply chain innovations to meet demand more effectively. Davis highlights the company’s proactive cost management approach, focusing on monitoring demand trends for high-cost materials like copper and conduit. This enables more resilient resource planning amidst fluctuating prices. She also notes that the EPA’s Aim Act, which phases out R-410 refrigerant-based HVAC systems by 2025, presents an additional regulatory hurdle. Gilbane is working to manage these changes by planning for increased costs associated with new, compatible A2L refrigerants, underscoring the importance of forward-looking cost management strategies.

How National Average Material Costs Are Determined

In this Quarterly Construction Cost Insights Report, we will be examining key data points surrounding construction material pricing. We will look at the Historical Cost Index, offering a retrospective lens on pricing trends, and the City Cost Index, providing a granular view of localized market variations. In addition, we will thoroughly explore the pricing trends of six key building materials:

- STRUCTURAL STEEL

- FRAMING LUMBER

- CONCRETE BLOCK

- CONDUIT

- COPPER ELECTRIC WIRE

- FIBERGLASS INSULATION

Raimond points out that fluctuating material prices have driven a need for more adaptable sourcing strategies. In particular, Gordian has observed that market volatility requires companies to actively monitor pricing trends and regional cost variations to avoid unexpected budget overruns. His insights emphasize the importance of agility and careful planning to mitigate the effects of price fluctuations in materials such as copper and structural steel.

Hensel Phelps has been advancing its sustainability practices through the use of Tangible, an embodied carbon tracker that evaluates the carbon impact of materials like concrete. This tool helps project teams make informed decisions to reduce the carbon footprint of high-impact materials. Additionally, the firm is exploring alternative materials like cross-laminated timber (CLT) and hempcrete.

Looking ahead, experts anticipate a stable yet cautious market, with sustained public sector demand and incremental pressures on labor and material costs. Interest rate cuts are expected to boost demand by mid-2025, particularly in public infrastructure projects. However, evolving regulatory requirements, environmental risks, and labor shortages will necessitate proactive cost management and agile sourcing strategies to remain competitive.

As the construction industry enters 2025, stabilized material costs and steady public sector demand provide a foundation of cautious optimism. Private sector growth, particularly in retail, has slowed, and ongoing labor shortages and regulatory changes present notable challenges. Industry leaders must continue innovating in supply chain management while addressing labor and regulatory pressures to stay ahead in a fluctuating market.

Building Resilient Supply Chains: Strategies for 2025 and Beyond

With persistent material cost pressures and supply chain disruptions, construction leaders are prioritizing resilience. Experts Courtney Davis from Gilbane Building Company and Ryan Martorano and Mark Rothman from Hensel Phelps emphasize adaptability and proactive planning to address these challenges.

GLOBAL INFLUENCES ON MATERIAL PRICING:

Courtney Davis, Supply Chain Analyst at Gilbane, points to global factors — such as China’s recent stimulus package — that are “boosting demand for building materials globally” and have led to “slightly upward” revisions in price forecasts through the end of 2024. While prices “likely reached a near-term low in Q3,” Davis notes that some costs “have begun to rally in Q4,” adding complexity to procurement planning.

DIVERSIFIED SOURCING FOR RESILIENCE:

Hensel Phelps experts stress the need for diversified sourcing, especially for materials like structural steel. “Structural steel faces specific challenges such as rising energy costs and tariffs on imported steel,” notes Chief Estimator Ryan Martorano and Corporate Director of Design and Sustainability Mark Rothman.

PREFABRICATION AND LABOR SHORTAGES:

Prefabricated assemblies offer a solution to labor shortages by reducing on-site time and reliance on skilled labor. Off-site fabrication helps mitigate labor constraints and improve project timelines, providing a timely advantage in today’s constrained labor market.

SUSTAINABLE MATERIALS FOR LONG-TERM RESILIENCE:

Martorano and Rothman also highlight sustainable materials like cross-laminated timber (CLT) and hempcrete as solutions for resilience and sustainability. “Hempcrete offers superior thermal performance, is carbon-negative, and provides excellent insulation,” they explain. CLT’s durable, eco-friendly properties support efficient construction and reduce environmental impact.

RESILIENCE AS A STRATEGIC IMPERATIVE:

As firms prepare for 2025, resilient supply chains are essential for navigating a complex market. By managing supply chain

risks and embracing sustainable practices, companies

can strengthen stability and position themselves to meet

future challenges.

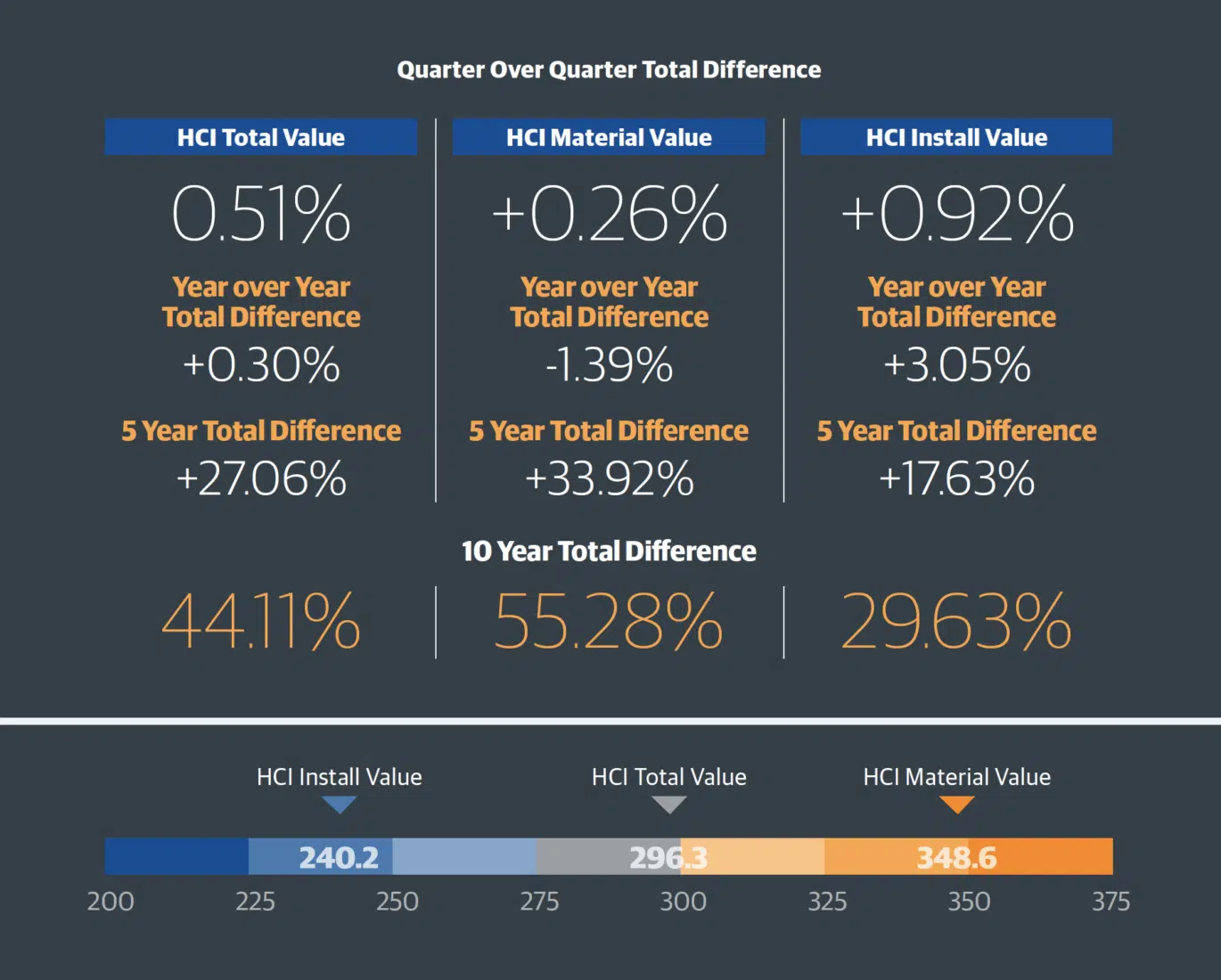

The HCI (Historical Cost Index) is an invaluable tool to track changes in the cost of construction materials and labor over time. The HCI Total Index Value represents the overall change in construction costs, including materials, labor and installation expenses. The HCI Material Value tracks the change in the cost of raw materials, such as lumber and steel. The HCI Install Value measures the change in the cost of installation labor, including plumbing, electrical and HVAC. These indices provide valuable insights, helping building industry professionals to anticipate and plan for changes in construction costs and make informed decisions about project budgets and timelines.

NOTES:

- The index values are based on a 30-city national average with a base of 100 on January 1, 1993. The three numbers are the total, material, and install index numbers, respectively, for the 30-city national average in 2024.

- The Historical Cost Index (HCI) applies the quarterly City Cost Index (CCI) updates to a historical benchmark and allows specific locations to be indexed over time. These indexes with RSMeans Data are a vital tool for forecasting construction costs and can be a valuable source of information for comparing, updating and forecasting construction costs throughout the United States.

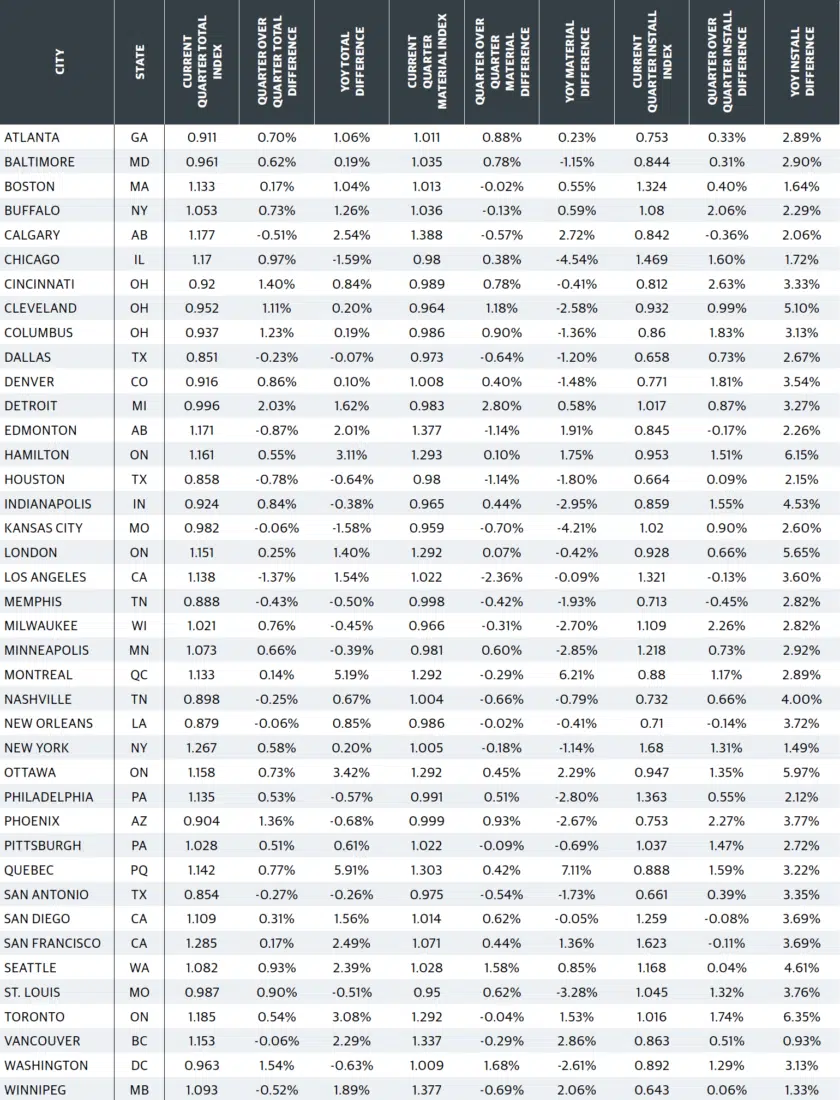

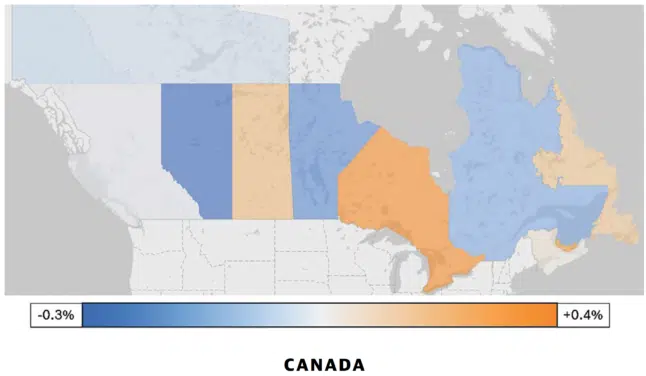

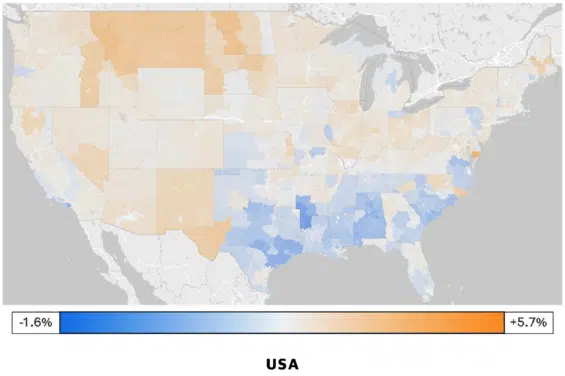

The City Cost Index is a quarterly data product designed to answer the question, “How much higher/lower are costs in my city relative to the national average?” The CCI can be used to better reflect localized pricing in construction estimates. Each quarter, Gordian’s RSMeans™ Data research team collects prices from cities across the United States and Canada, which are then compared to the national average and the current year’s annual release data to create the CCI. The City Cost Index shows a factor for Material, Installation and Total with rows representing multiple CCI divisions. Additionally, the CCI shows a Material Total, Installation Total and a Total Weighted Average.

Q3 2024 to Q4 2024

Overall, material costs have regressed mildly to a state of equilibrium over the last quarter. This stabilization is due in part to increased market confidence following the Federal Reserve’s decision to lower its target interest rate in September.

In the U.S., there are some regional price trends in certain material categories. For example, framing lumber costs are generally less expensive in the Midwest than they are in most other areas of the country. A variety of factors could be responsible for these differences, but it’s not clear in this case which are the most responsible. But some of the contributing factors are the common species of wood used in that region, distance from Canada (which exports over 10x more wood products to the U.S. than any other country), new construction activity in the region, among other factors.

What the data says:

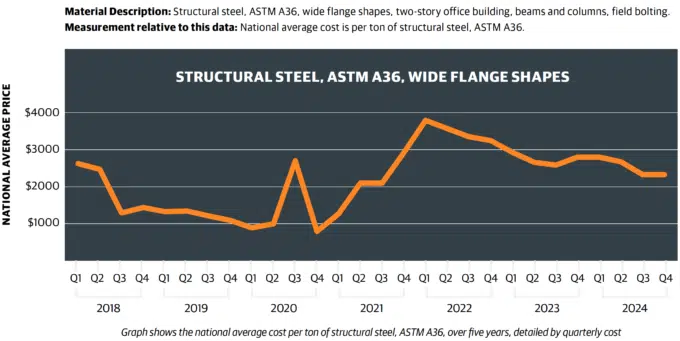

- 2024 Overview: Prices fluctuated, reflecting global demand and supply shifts.

- Q3: A significant 10.68% decrease marked a stabilization trend, with an 8.18% year-over-year decrease.

- Q4: End-of-year prices remained flat from Q3, down 14.07% year-over-year, reflecting sustained low demand.

View from the field:

GILBANE: “Structural steel prices have been on the decline and are expected to continue falling through the end of the year. Suppliers may enact an arbitrary price hike in Q1 2025, but it is unlikely to last due to waning demand.”

HENSEL PHELPS: “Structural steel faces specific challenges such as rising energy costs and tariffs on imported steel. Advances in recycling and increased use of scrap steel present opportunities to mitigate some of these challenges.”

Read more on what the data says about steel.

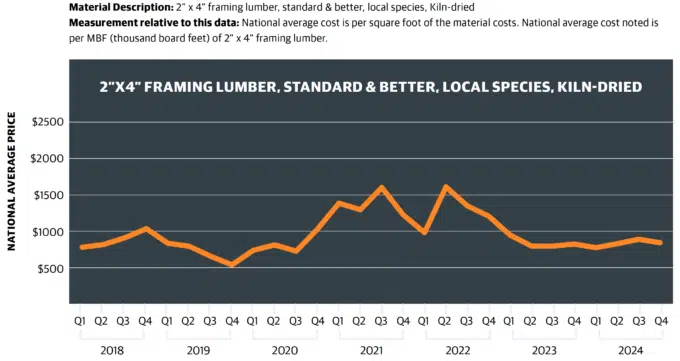

What the data says:

- 2024 Overview: Lumber prices fluctuated, with early declines and a mid-year rebound.

- Q3: National prices rose by 7.61% quarter-over-quarter and 12.12% year-over-year.

- Q4: Prices decreased by 5.44% from Q3, stabilizing closer to Q1 levels.

View from the field:

GORDIAN: “We observed a sizable drop in plywood and plyform costs over the last quarter. Framing lumber prices remain far lower than their peaks in 2022.”

GILBANE: “Weak demand limits price rallies, but lumber prices may rise modestly in Q4 in response to recent interest rate cuts.”

HENSEL PHELPS: “Framing lumber is primarily affected by demand and supply chain disruptions, though advancements in engineered lumber and sustainable forestry practices offer potential solutions.”

Read more on what the data says about lumber.

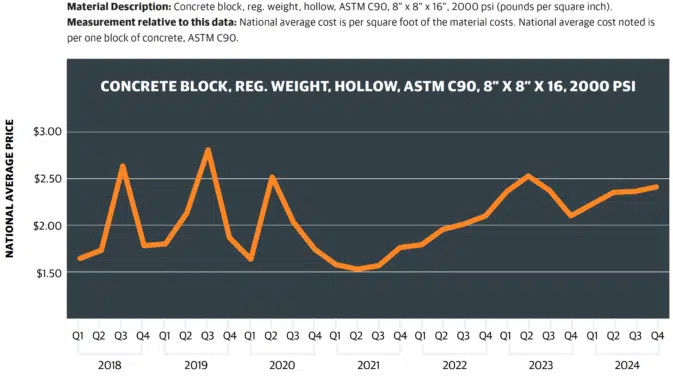

What the data says:

- 2024 Overview: Prices fluctuated with regional supply dynamics.

- Q3: Prices stabilized with a 0.42% increase.

- Q4: Prices rose by 2.10% from Q3, showing a 15.17% year-over-year increase, indicating strong demand.

View from the field:

GORDIAN: “Prices for blocks and other concrete products have steadily risen, with demand expected to persist.”

GILBANE: “Suppliers are carefully monitoring inventory, expecting prices to remain steady or rise modestly.”

HENSEL PHELPS: “Concrete block production is challenged by high energy costs and transportation expenses, but developing low-carbon concrete and alternative materials offers potential mitigation.”

Read more on what the data says about concrete block.

What the data says:

- 2024 Overview: Conduit prices fluctuated moderately throughout the year.

- Q3: Minimal change with a 0.60% increase.

- Q4: A slight 2.85% decrease from Q3 reflects supply adjustments.

View from the field:

GORDIAN: “Conduit prices stayed consistent over the past 18 months due to stable aluminum and galvanized steel prices.”

GILBANE: “Conduit pricing has stabilized, with slight increases possible if raw material costs change.”

HENSEL PHELPS: “The fluctuating cost of steel and aluminum affects conduit production, but composite materials provide a possible solution.”

Read more on what the data says about conduit.

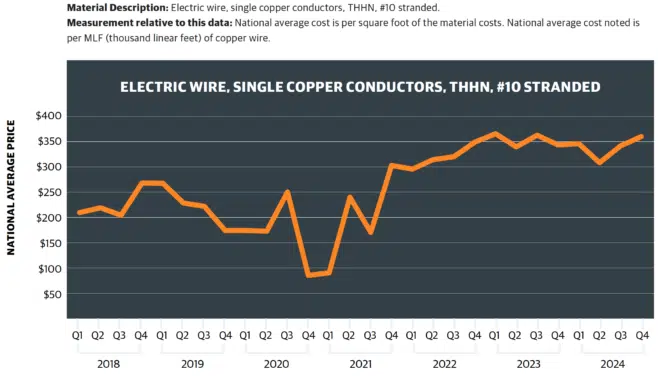

What the data says:

- 2024 Overview: Copper wire pricing saw significant shifts due to global demand.

- Q3: Prices rebounded by 10.62%, despite a moderate year-over-year decrease of 5.85%.

- Q4: Prices remained steady, with a slight increase of 0.37% from Q3.

View from the field:

GORDIAN: “Copper costs are increasing now that demand for projects and items requiring copper are rising. The supply was unexpectedly high in the past year, but moving forward could be more strained due to the increased usage in projects.”

GILBANE: “Copper prices are rebounding in Q4 in response to U.S. interest rate cuts and China’s stimulus.”

HENSEL PHELPS: “Copper wire faces challenges due to global demand driven by electrification and renewable energy, yet advancements in recycling and alternative conductive materials present new opportunities.”

Read more on what the data says about copper electric wire.

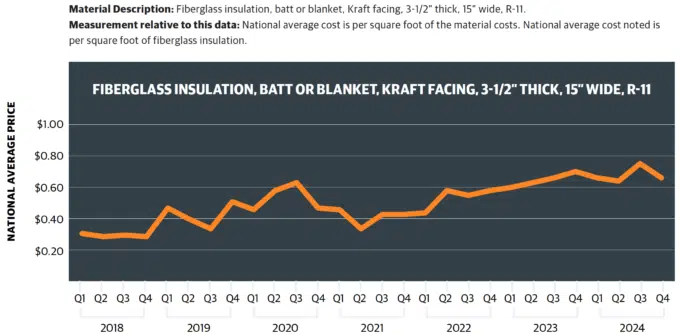

What the data says:

- 2024 Overview: Insulation prices showed varied trends across the year.

- Q3: Prices spiked by 16.67% amid tightening supply.

- Q4: Prices decreased by 11.69% from Q3, indicating a market correction.

View from the field:

GORDIAN: “The insulation market is volatile, with Q3 prices spiking nearly 17%. Q4 shows a decline of over 11%, aligning with a 5.56% year-over-year decrease.”

GILBANE: “Fiberglass insulation remains on allocation due to consistent demand pressures and tight supply.”

HENSEL PHELPS: “Fiberglass insulation production is impacted by rising raw material costs and energy requirements. Still, improvements in manufacturing efficiency and the increased use of recycled glass could help offset these challenges.”

Read more on what the data says about fiberglass insulation.

The Following Supply Chain and Preconstruction Subject Matter Experts Contributed Their Views for this Q4 2024 Analysis:

GORDIAN

- Adam Raimond, Construction Index Manager

- Sam Giffin, Director, Data Operations

GILBANE BUILDING COMPANY

- Courtney Davis, Supply Chain Analyst

HENSEL PHELPS

- Ryan Martorano, Chief Estimator

- Mark Rothman, Corporate Director of Design and Sustainability

Additional Resources

Share this: