Executive Summary

The commencement of 2024 ushers in a much-anticipated era of stability in construction material pricing, providing a respite from the turbulence experienced in recent years. Insights gathered from industry leaders at Gordian, Mortenson, Messer Construction Co. and The Beck Group form the foundation of this Q1 report, reflecting the collective expertise of professionals navigating the complexities of the current market. While acknowledging ongoing challenges in specific product categories, the report unveils a prevailing trend of stabilization within the construction sector, highlighting the industry’s ability to find its footing amid dynamic market forces.

According to Gordian, the prevailing trend indicates that, at a macro level, material prices in the construction sector are stabilizing as the new year unfolds. While specific product types and commodities may still face challenges and price movements, the past six months have shown a relative lack of dramatic changes in pricing dynamics.

Gordian highlights an interesting development — the case of drywall. Despite persistently elevated prices since the pandemic, there has been a noteworthy six-month period marked by consistent price declines, with drywall prices per square foot experiencing an 11% decrease from their peak in the preceding summer.

Clark Taylor, Vice President of Estimating at Mortenson, provides insights, noting that while ongoing pressures persist, supply chains have generally stabilized, establishing a new normal. The recommendation is to plan for escalation in line with historical averages of 3% to 5% per year. However, some volatility may persist due to factors such as weather, global demand and unforeseen world events. Jacob Eglseder, Mortenson’s Director of Supply Chain, highlights a focus on long lead times of electrical equipment, particularly transformers and circuit breakers. Despite gradual improvements in lead times

for several material categories, they remain significantly elevated compared to pre-pandemic levels.

Additionally, Eglseder emphasizes the softening across several commodities from a material cost perspective. However, he cautions that Mortensen expects continued volatility influenced by current geopolitical events and fluctuating demand.

Messer’s Matt Verst, Vice President of Cost Planning and Estimating, shares insights into the HVAC and electrical equipment landscape, noting that while cost increases have become more predictable, lead times remain a persistent challenge. HVAC equipment lead times have plateaued above historical norms, and volatility persists for electrical equipment such as generators, switchgear and transformers. Structural steel, conduit and copper wire, however, after experiencing rapid increases from 2020 to 2022, have begun to stabilize slightly below their three-year highs.

Greg O’Bryan, Senior Preconstruction Analytics Manager at The Beck Group, sheds light on the labor aspect, highlighting growing concerns over skilled labor availability. He notes that despite the broader economy witnessing a narrowing gap between needed and available workers, the construction sector anticipates potential strains in this relationship in the coming quarters. On the materials front, lead times have largely returned to normal or near-normal ranges, with exceptions in electrical system equipment and specific custom HVAC items. O’Bryan cautions that delays of up to 18 months for certain items could potentially extend overall project schedules.

Building Models Used To Calculate Price Data

Gordian’s data team researches material, labor and equipment prices and quantities in cities across the U.S. and Canada to create a composite cost model, which is weighted to reflect actual usage in the building construction industry. To capture the types of construction activity typically performed across North America, researchers merged nine building types, which represent those most commonly found across America and Canada. They are:

1. FACTORY (one story)

2. OFFICE (two to four stories)

3. STORE (retail)

4. TOWN HALL (two to three stories)

5. HIGH SCHOOL (two to three stories)

6. HOSPITAL (four to eight stories)

7. GARAGE (parking)

8. APARTMENT (one to three stories)

9. HOTEL/MOTEL (two to three stories)

In terms of a comprehensive outlook on near-future material pricing in the construction sector, Gordian predicts continued stability, citing a 3.5% overall cost decrease in 2023 despite potential disruptions from global events. With supply chains stabilizing, Mortenson anticipates a return to historical price escalation factors, emphasizing the need for resilience in project planning amid localized cost increases driven by mega projects and labor shortages.

Messer expects continued predictability in lead times and material cost increases in 2024, balancing potential easing with tight labor market pressures. The firm closely monitors the impact of mega projects and election-related uncertainties.

The Beck Group foresees a modest increase in construction pricing over the next six to 10 months, shaped by onshoring efforts for stability, a tight labor market and ongoing challenges in labor availability. Collectively, these insights highlight the dynamic interplay of factors shaping material pricing trends, emphasizing resilience, predictability and the ongoing impact of global events and market dynamics.

How National Average Material Costs Are Determined

Gordian’s team contacts manufacturers, dealers, distributors and contractors all across the U.S. and Canada to determine national average material costs. Included within material costs are fasteners for a normal installation. Gordian’s engineers use manufacturers’ recommendations, written specifications and/or standard construction practice for size and spacing of fasteners. The manufacturer’s warranty is assumed. Extended warranties and sales tax are not included in the material costs.

Note: Adjustments to material costs may be required for your specific application or location. If you have access to current material costs for your specific location, you may wish to make adjustments to reflect differences from the national average.

As we enter 2024, this report delves into significant trends in the construction industry concerning material prices, unveiling a landscape marked by overall stabilization or even a slight reduction over the past 18 months. This shift comes in contrast to the sharp price increases witnessed during the pandemic, providing a welcome relief from the extreme volatility of 2021 and 2022.

In This Quarterly Construction Insights Report:

In this Quarterly Construction Cost Insights Report, we will be examining key data points surrounding construction material pricing. We will look at the

Historical Cost Index, offering a retrospective lens on pricing trends, and the City Cost Index, providing a granular view of localized market variations. In

addition, we will thoroughly explore the pricing trends of six key building materials:

• Structural Steel

• Framing Lumber

• Concrete Block

• Conduit

• Copper Electric Wire

• Fiberglass Insulation

Focus on Fiberglass Insulation Costs

Fiberglass insulation is a construction material used to reduce the transfer of heat, sound and electricity. This vital building component helps to lower energy costs, decrease greenhouse gas emissions, reduce noise pollution and increase safety.

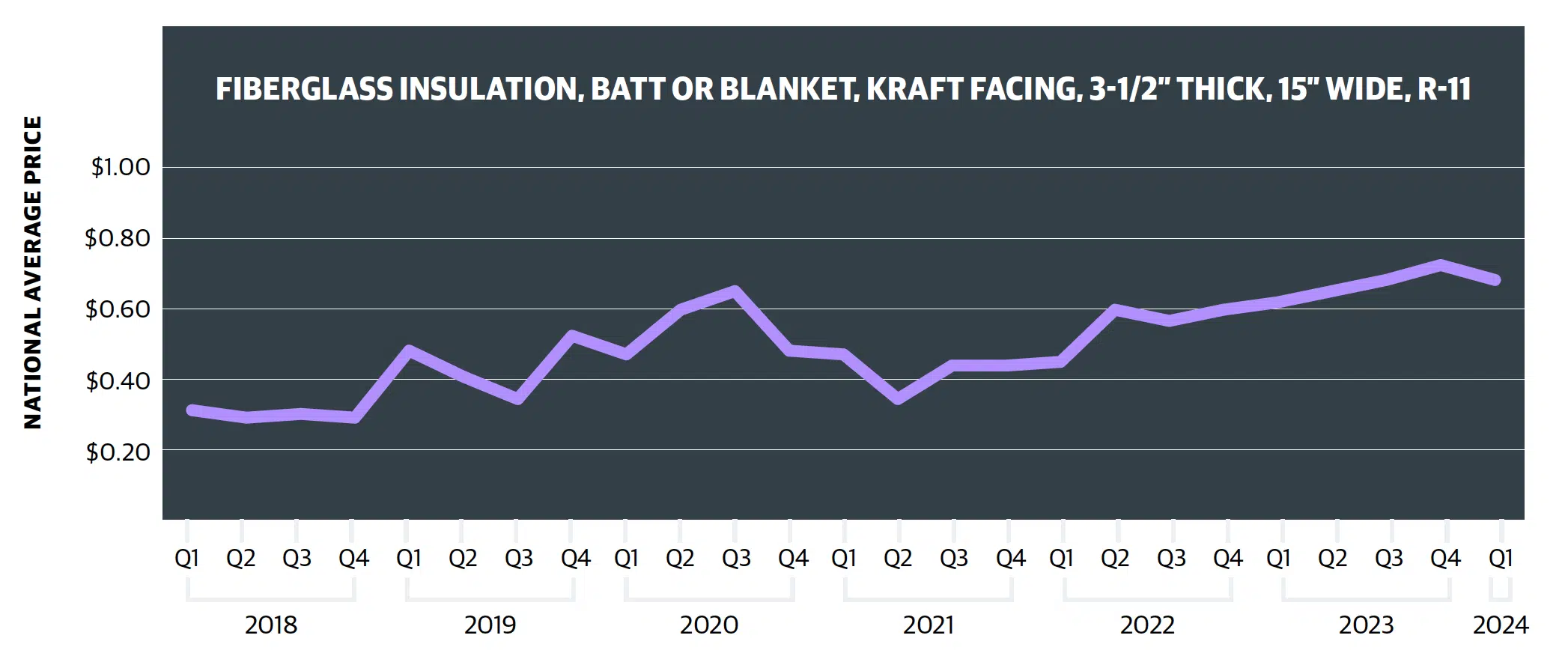

The escalating prices of batt or blanket fiberglass insulation can pose a significant challenge to the profitability of building projects. Exacerbated by ongoing shortages and increased demands within the industry, fiberglass insulation costs have risen steadily throughout the past year despite short-term fluctuations. Since the second quarter of 2021, the cost for blanket fiberglass insulation has increased nearly 90%.

Contributing Factors for Fluctuations in Fiberglass Insulation Costs

The surge in demand for insulation is attributed to several factors, including:

ENERGY EFFICIENCY:

Today’s families and businesses prioritize energy-efficient homes and buildings due to rising energy costs and environmental concerns. To achieve high-performance structures, builders must incorporate substantial amounts of insulation in outer walls, floors, ceilings, as well as pipe and duct insulation. Such insulation practices can lead to energy savings of up to 50% compared to structures without insulation.

HOME BUILDING MARKET:

Though the recently flourishing home building market seems to be cooling, home prices remain high. This has placed a strain on the availability of insulation, further exacerbating the supply shortage.

GOVERNMENT POLICIES:

Government regulations have heightened the demand for insulation. In 1965, building codes in the U.S. only required insulation in the walls of homes. The 2021 Residential International Energy Conservation Code (IECC) has increased the required R-values (a measurement of heat resistance) for insulation in attics, slabs and continuous insulation for walls compared to previous standards.

All of these things contribute to the increase in batt or blanket fiberglass insulation costs, but there are still additional factors. Gordian’s data engineers track many different influential factors, examining macroeconomic conditions to better understand cost shifts.

Gordian regularly collects, validates and analyzes North American construction material, labor and equipment costs to enable our customers to create reliable project budgets, build estimates and validate price proposals. Thanks to the 30,000+ hours of research Gordian devotes to construction costs every year, their experts can examine the price of fiberglass insulation and tens of thousands of other line items from every corner of the U.S. and Canada.

The Effects of Rising Fiberglass Insulation Costs

A wide range of engineers, architects, estimators, contractors and facility owners depend on accurate construction cost data to plan new building construction and renovation projects. Looking at historical trend lines, it is likely insulation costs will continue to increase in 2024. Building construction is the largest market for fiberglass insulation, which is the most common insulation used in both residential and commercial projects.

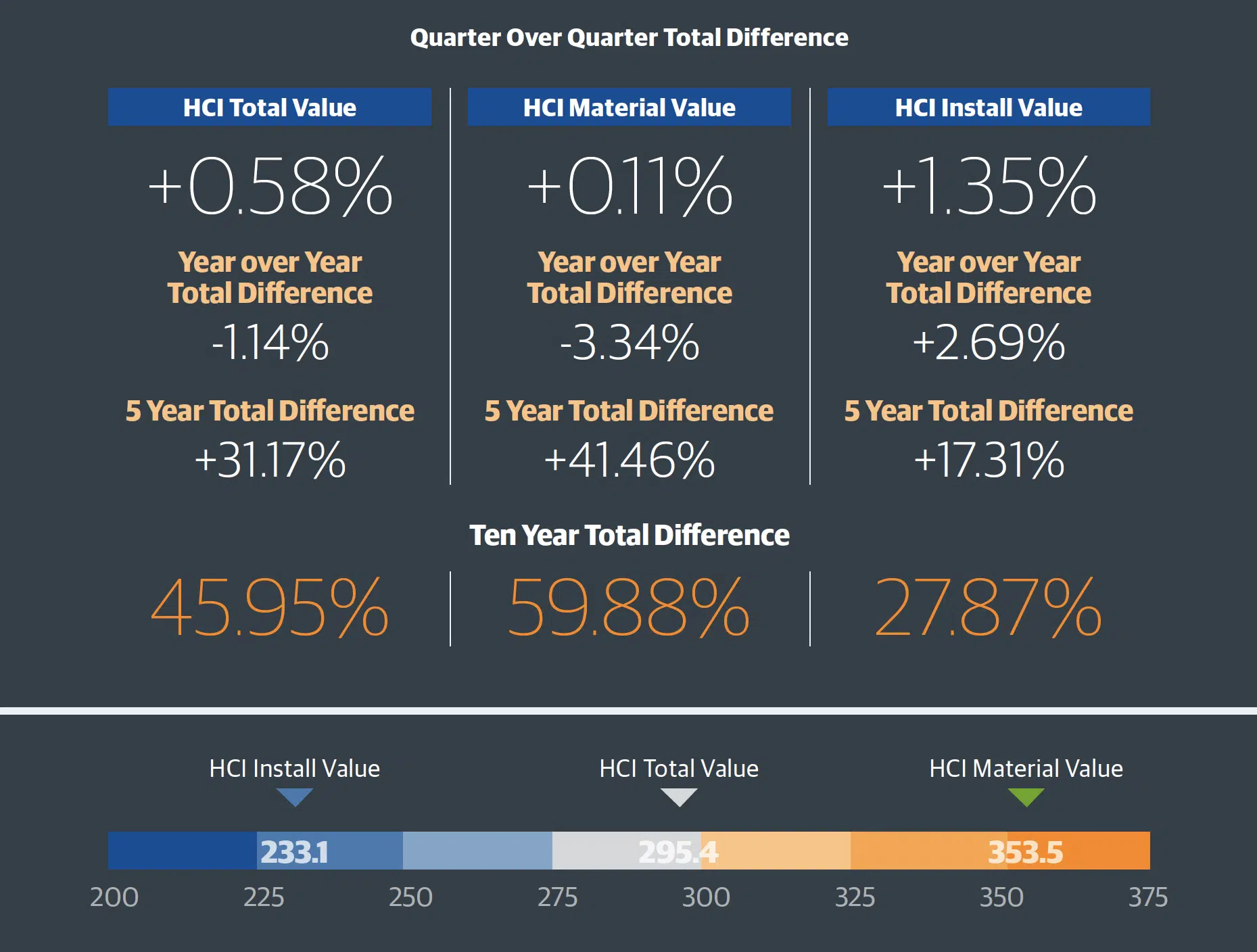

The HCI (Historical Cost Index) is an invaluable tool to track changes in the cost of construction materials and labor over time. The HCI Total Index Value represents the overall change in construction costs, including materials, labor and installation expenses. The HCI Material Value tracks the change in the cost of raw materials, such as lumber and steel. The HCI Install Value measures the change in the cost of installation labor, including plumbing, electrical and HVAC. These indices provide valuable insights, helping building industry professionals to anticipate and plan for changes in construction costs and make informed decisions about project budgets and timelines. Historical Cost Index and HCI 10-Year Data Quarter Over Quarter Total Difference

NOTES:

- The index values are based on a 30-city national average with a base of 100 on January 1, 1993. The three numbers are the total, material, and install index numbers, respectively, for the 30-city national average in 2023.

- The Historical Cost Index (HCI) applies the quarterly City Cost Index (CCI) updates to a historical benchmark and allows specific locations to be indexed over time. These indexes with RSMeans Data are a vital tool for forecasting construction costs and can be a valuable source of information for comparing, updating, and forecasting construction costs throughout the United States.

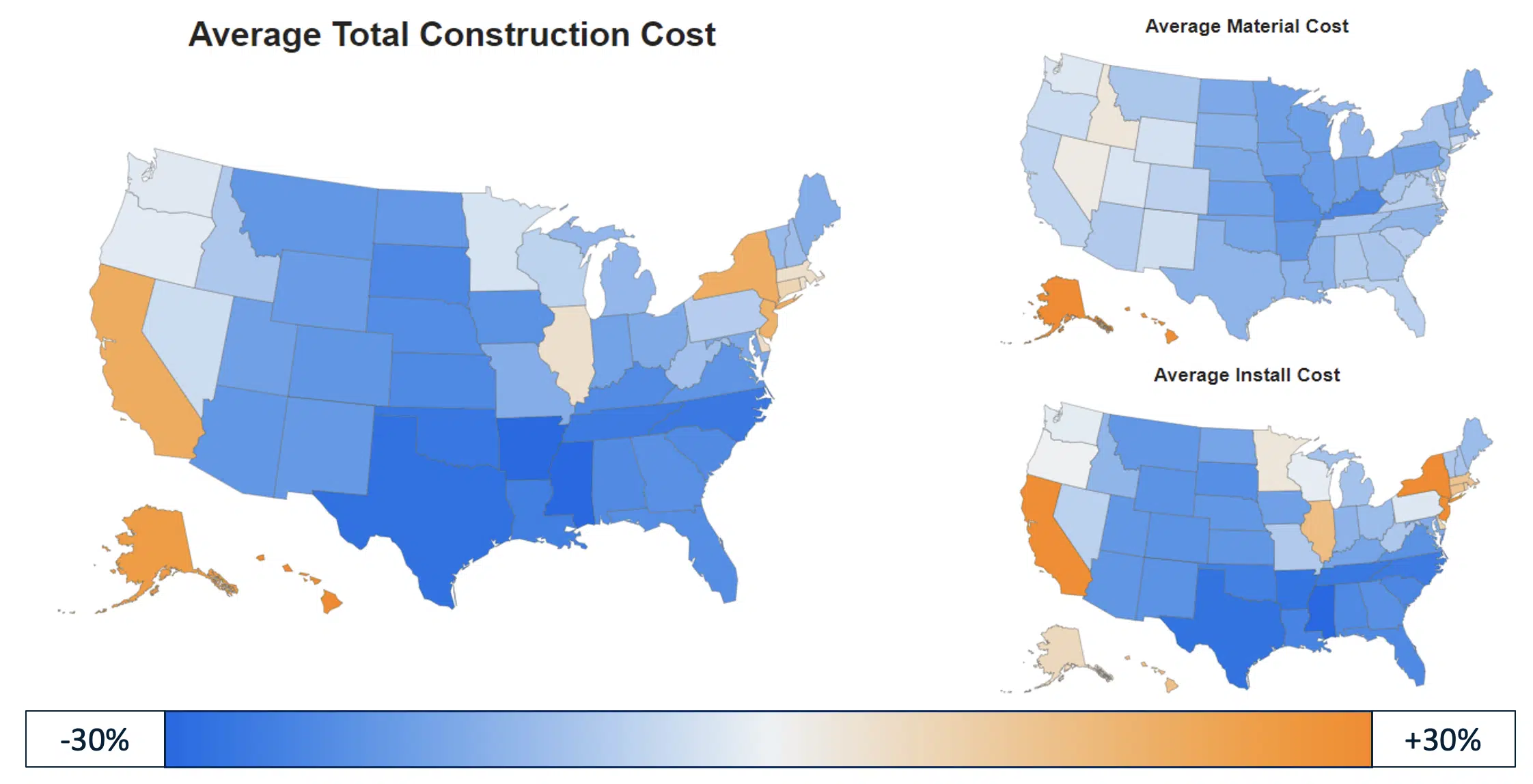

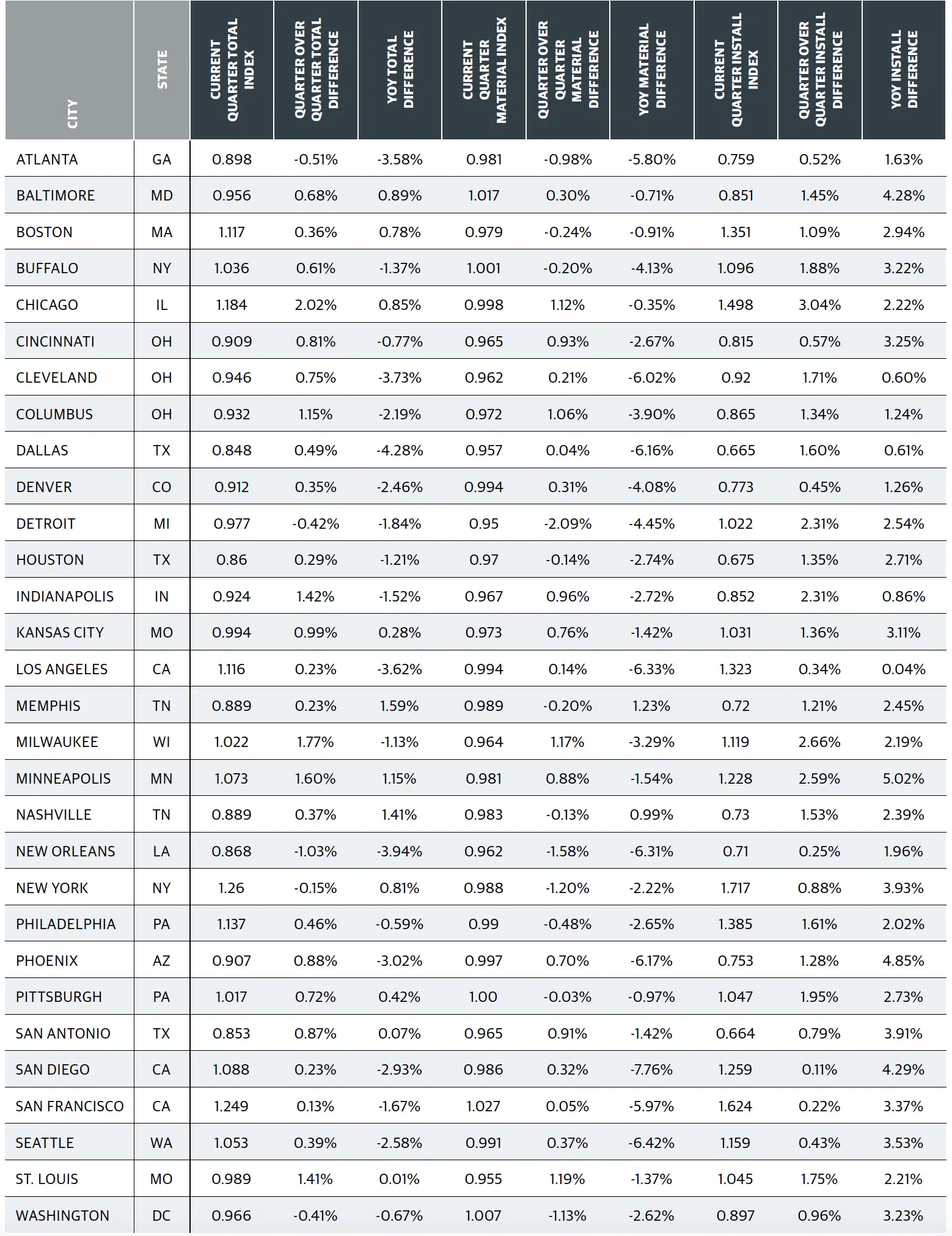

The City Cost Index is a quarterly data product designed to answer the question, “How much higher/lower are costs in my city relative to the national average?” The CCI can be used to better reflect localized pricing in construction estimates. Each quarter, Gordian’s RSMeans Data research team collects prices from cities across the United States and Canada, which are then compared to the national average and the current year’s annual release data to create the CCI. The City Cost Index shows a factor for Material, Installation and Total with rows representing multiple CCI divisions. Additionally, the CCI shows a Material Total, Installation Total and a Total Weighted Average.

State-Level Cost Trends

Overall, construction costs saw a modest dip of 1.25% from Q3 2023 to Q1 2024, led by a 3.5% fall in material costs as major commodity material continue to

stabilize. Meanwhile, labor costs saw a slight increase of 2.7%, driven by a shortage of skilled workers. Regional cost variations are notable, with areas

throughout Georgia experiencing the largest increases of up to 4%, while areas throughout Idaho saw a decline in overall total cost of around 2.8%, attributed to Gordian’s expansion within their supplier collection during this quarter. Despite a slight overall cost reduction, construction expenses remain prone to increases from regional dynamics, resource scarcity, and labor expenses.

Want to see how your projects are impacted by localized costs? Sign up for a free trial of RSMeans Data Online to see our data in action.

Sustainability in Construction: Demand for Eco-friendly Materials Drives Innovations

Innovations within the construction sector underscore a significant commitment to advancing sustainability and reshaping industry norms. Mortenson, for example, integrates low embodied carbon materials, aligning with the U.S. Federal Buy Clean Initiative to reduce greenhouse gas emissions. Julianne Laue, Mortenson’s Director of Building Performance, shares that this dedication extends to fostering environmentally responsible construction practices, including a focus on materials transparency evident in projects requiring Environmental Product Declarations (EPDs). Similarly, Messer contributes to this landscape with a strategic focus on ESG (environmental, social and governance) initiatives, energy resilience and innovative solutions like thermal energy storage and leveraging mass timber. Meanwhile, The Beck Group emphasizes sustainability in building material procurement, aligning with regulatory frameworks and meeting client interest in third-party green building certifications.

The industry’s evolution towards greater transparency and accountability is evident, with manufacturers developing superior products to meet stringent requirements. Clients actively pursuing third-party green building certifications signal a future where sustainability takes center stage, thereby influencing material pricing trends.

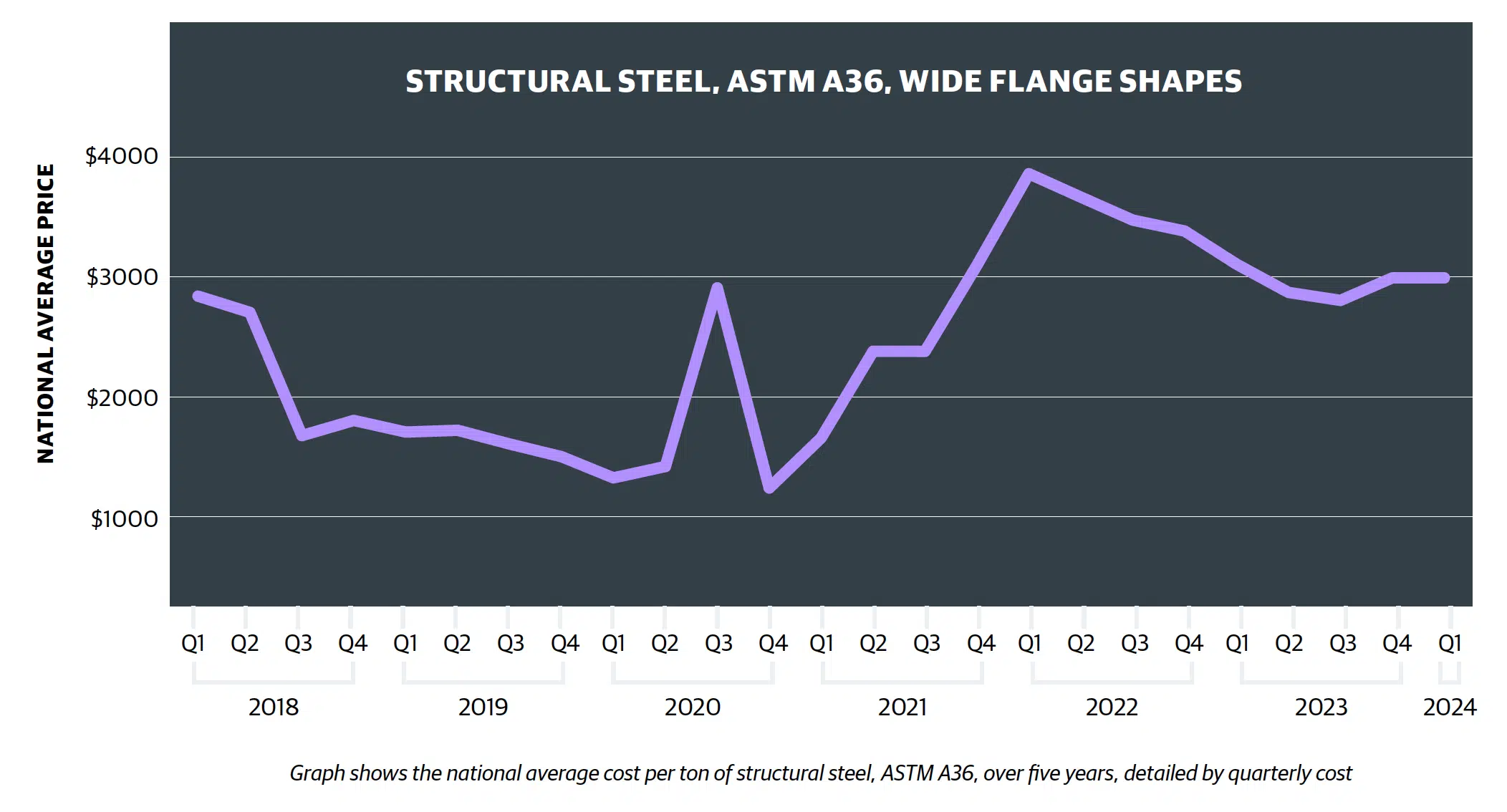

What the data says:

- Cost acceleration in late Q1/Q2 2022 due to supply chain constraints

- Cost stabilizations/decrease continued into Q1/Q2/Q3 2023

- Q4 2023 saw a 6.85% quarter-over-quarter increase, but still below the highs of 2022

- No change between Q4 2023 and Q1 2024; Q1 sees year-over-year decrease of 3.75%

View from the field:

- MORTENSON: “Structural steel supply chain has stabilized, supply is favorable, demand continues to be strong and pricing is stable.”

- MESSER CONSTRUCTION CO.: “After seeing rapid increases from 2020 to 2022, we’ve seen structural steel, conduit and copper wire begin to stabilize slightly below their three-year highs.”

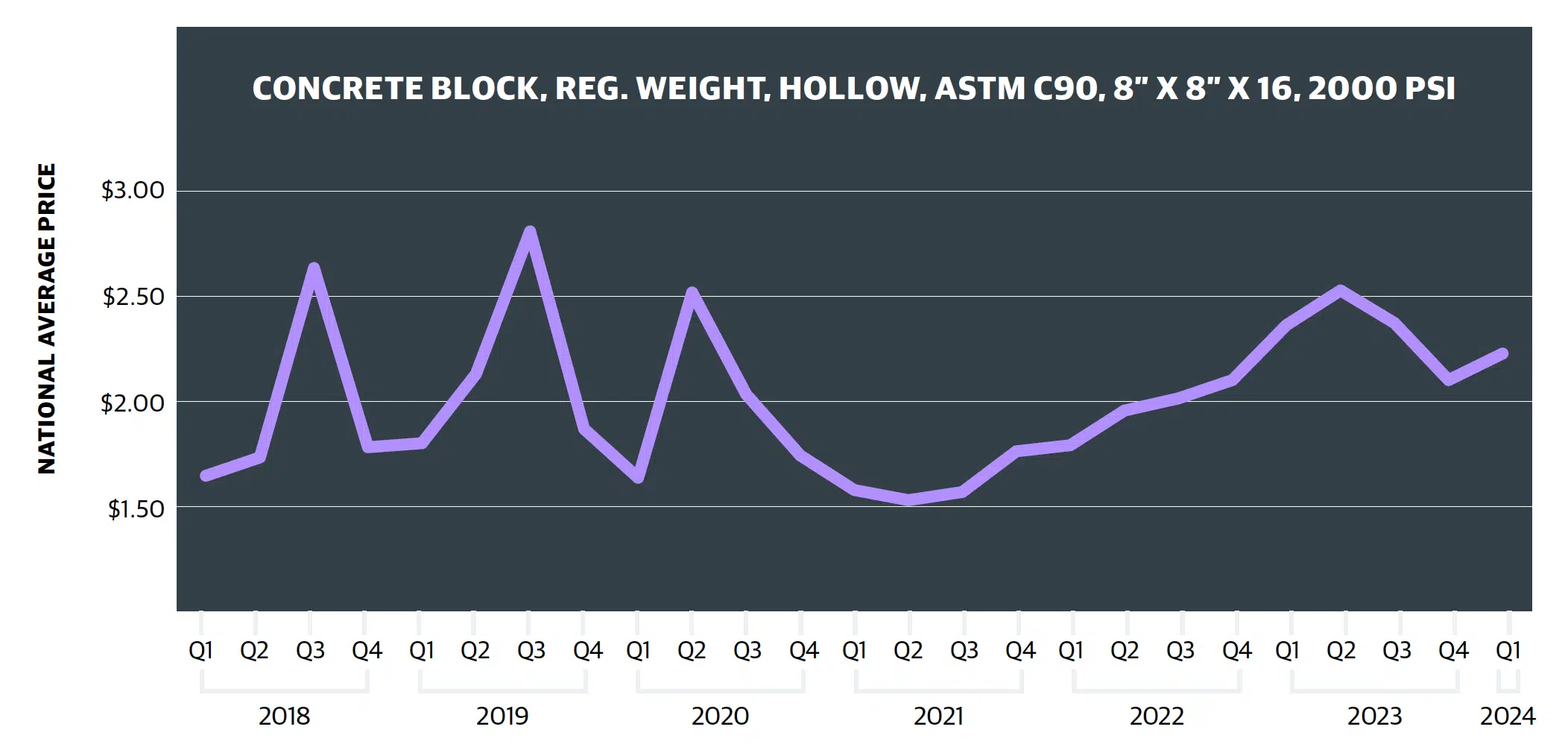

What the data says:

- High price increases through most of 2022 were driven by supply constraints

- Q2 2023 rose, but at a lower rate than Q1; Q3 and Q4 each saw a slight decline

- Q1 2024 sees a 6.16% increase from Q4 2023

View from the field:

- GORDIAN: “Prices for concrete products are at a peak, and don’t show any sign of decreasing. Demand is high, and production of concrete is being restrained by shortages of raw materials like sand.”

- MESSER CONSTRUCTION CO.: “Concrete block prices continue to climb and are at three-year highs. In contrast, lumber prices are near three-year lows. If interest rates drop in 2024, there may be a resulting uptick in residential construction, which often influences the price of lumber.”

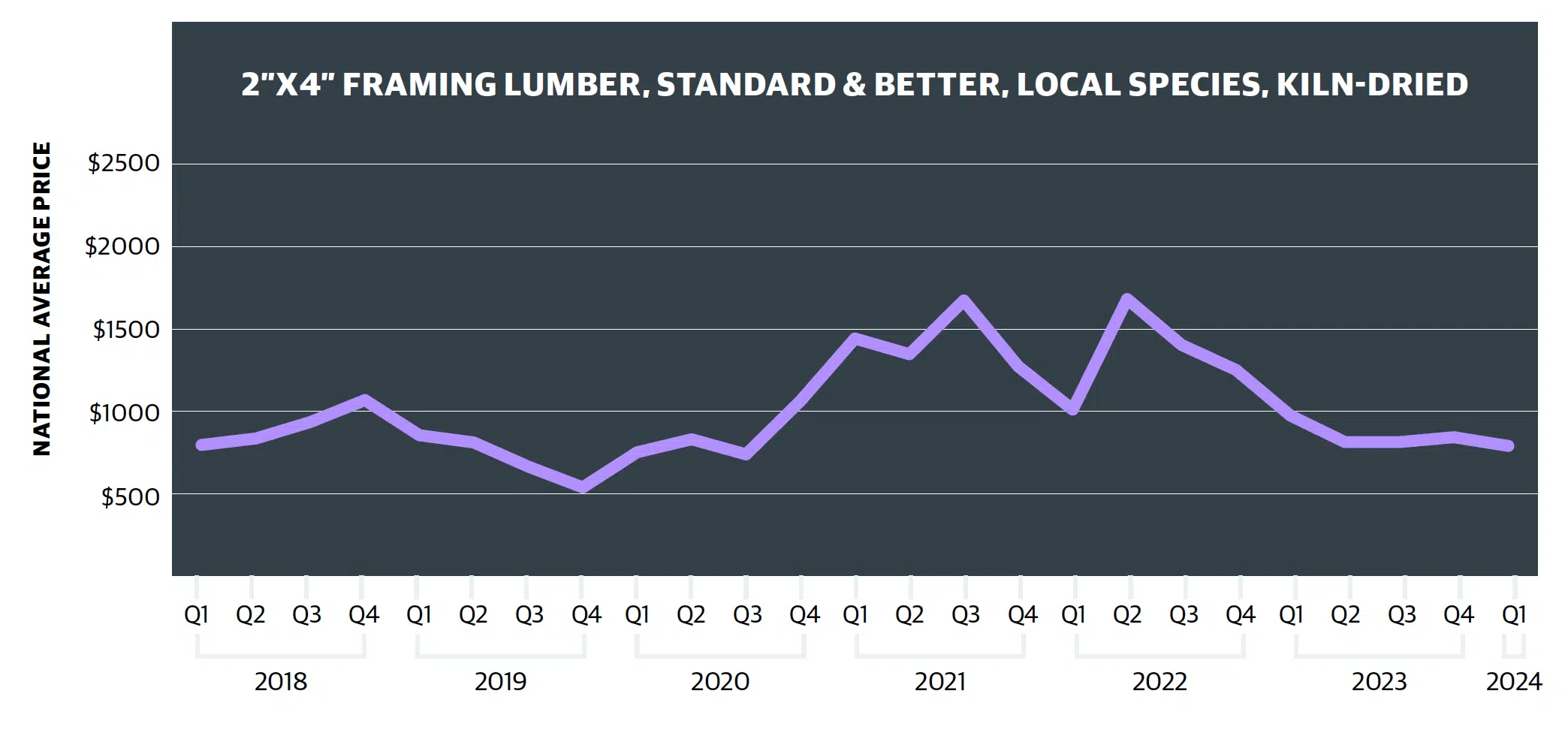

What the data says:

- 2023 lumber prices declined after climbs since 2020

- Pricing stabilization/decrease seen in Q2/Q3 2023, with slight increase in Q4 2023

- Q1 2024 is seeing a 6.24% decrease since Q4 2023, and a tremendous year-over-year decrease of 18.78%

View from the field:

- GORDIAN: “Lumber costs are currently at their lowest since summer 2020, but wildfires in North America could reverse that trend. When wildfires intensified in several Canadian provinces in June, prices temporarily saw an increase due to damage done to a large part of Canada’s forests.”

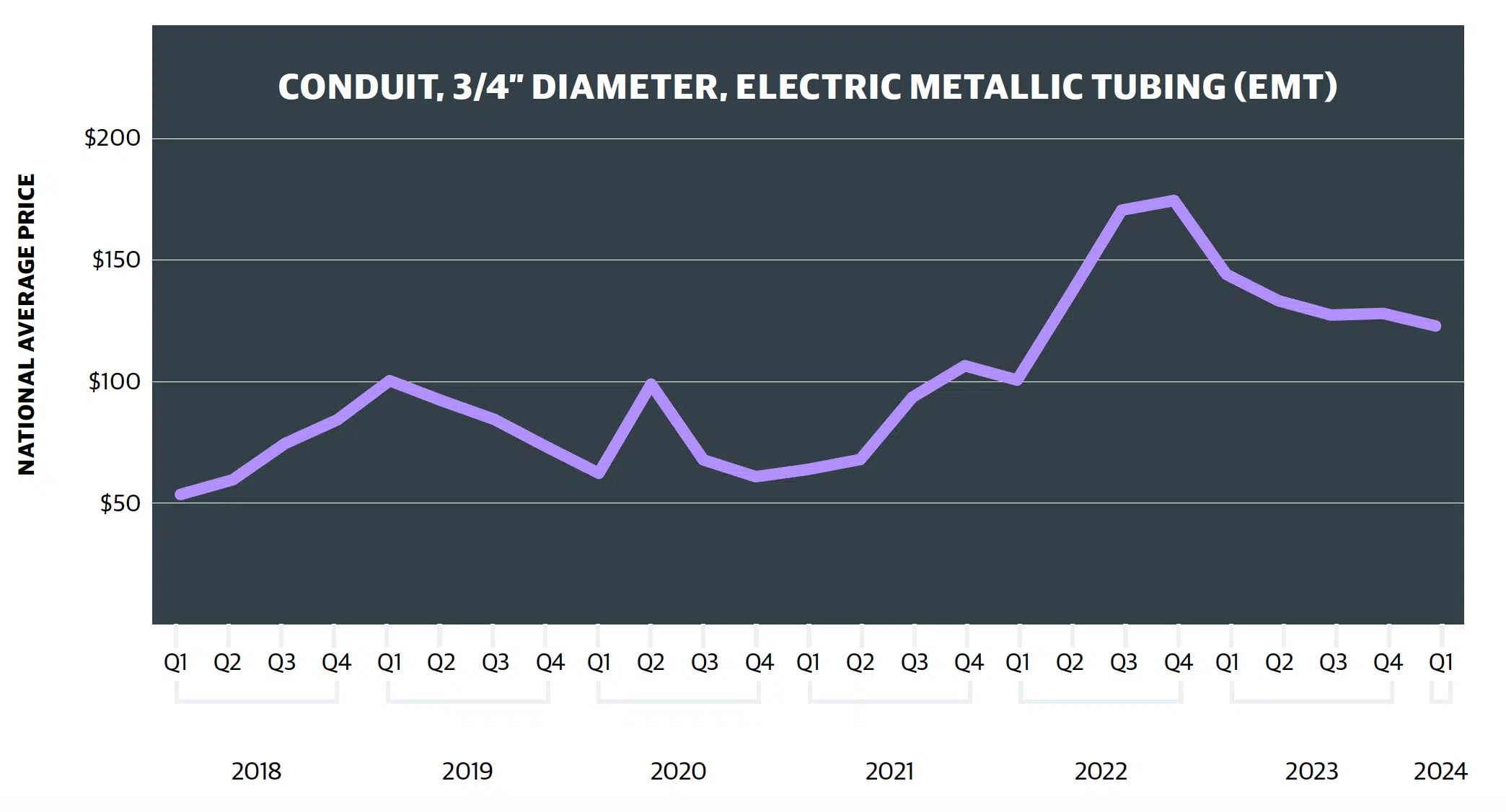

What the data says:

- Significant escalations in Q2 – Q4 2022 driven by the international supply chain

- 2023 prices slowly came down from 2022 highs, although Q4 did experience a very slight increase ( just over 0.5%)

- Conduit pricing in Q1 2024 is down just over 4% since Q4, but has decreased almost 15% from this time last year

View from the field:

- GORDIAN: “Based on recent trends, pricing for conduit should not see much variability in the coming months.”

- MORTENSON: “Not a significant driver of cost, but some variability expected.”

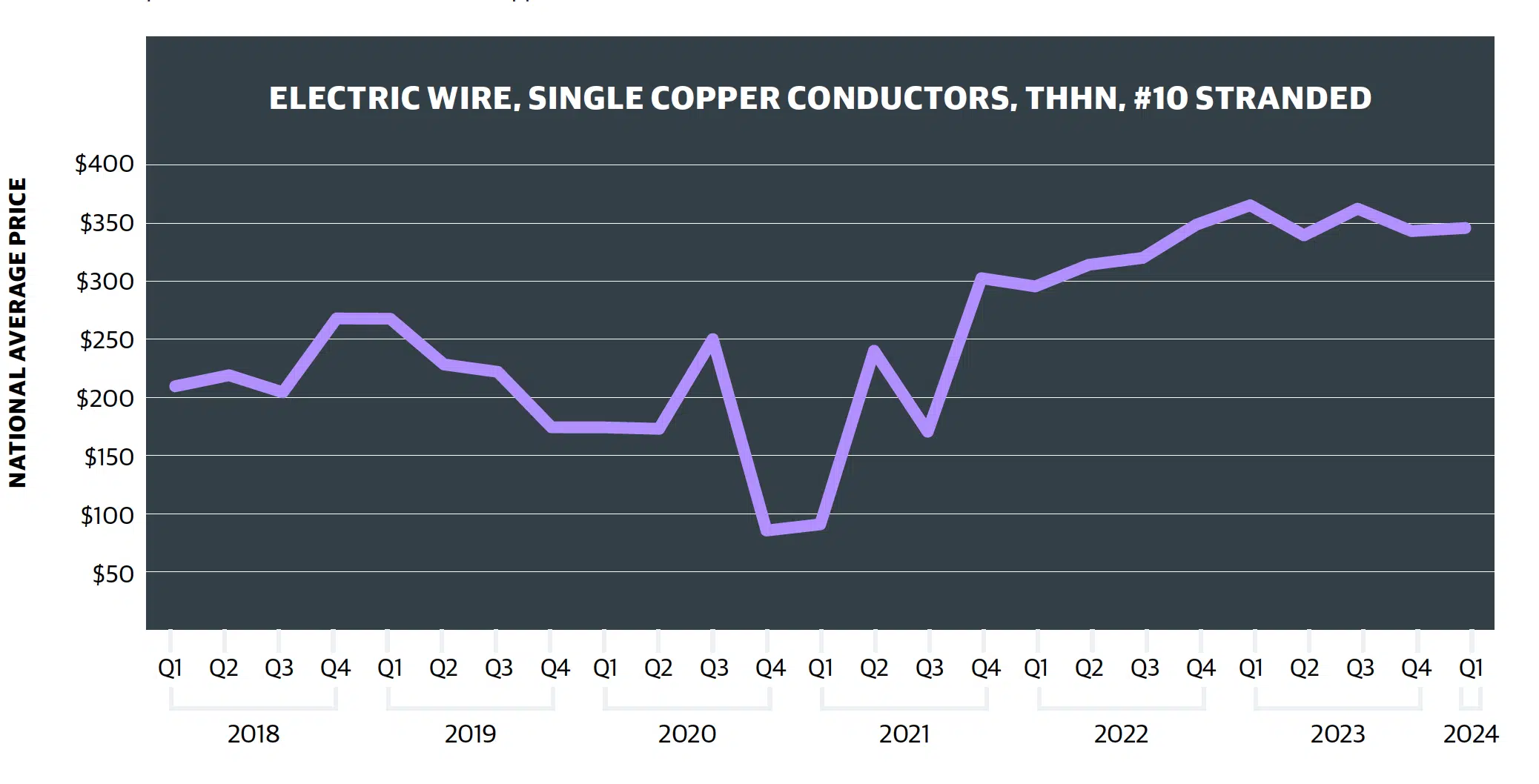

What the data says:

- Significant escalations in Q2 – Q4 2022 were driven by international supply chain issues

- Copper price increases continued into 2023, although closed out Q4 with a minor decrease from Q3

- Q1 2024 is virtually unchanged from Q4 2023, increasing less than 1%; year-over-year pricing is down just over 5%

View from the field:

- GORDIAN: “Pricing for copper wire has stayed consistent in the past several months, likely because until recently, there was a surplus expected in 2024. However, operations at mines in Panama and Peru have ceased operations, and it’s unknown as of now if that pause will be permanent or only temporary.”

- MORTENSON: “Expect continued strong demand with the electrification of the country. The shutdown of First Quantum’s Cobre mine in Panama will have an impact as well.”

- THE BECK GROUP: “On the materials side, most lead times have returned to normal or near-normal ranges after the supply chain disruptions of the past few years. However, exceptions exist, notably in electrical system equipment and certain custom HVAC items.”

What the data says:

- Supply shortages drove up prices in Q1 2022 after two years of decline

- Prices held at these higher levels in 2023, creeping up each quarter

- While Q1 2024 fiberglass insulation pricing saw a decrease (under 6%) from Q4, the year-over-year increase is more than 9%

View from the field:

- GORDIAN: “Prices for fiberglass insulation have risen continuously in the previous year, going up over 20% year-over-year. This is likely to continue, in part due to credits families can claim for adding and installing new insulation in their homes from the Inflation Reduction Act.”

The Following Supply Chain and Preconstruction Subject Matter Experts Contributed Their Views For This Q1 2024 Analysis:

MESSER CONSTRUCTION CO.

- Matt Verst, Vice President of Cost Planning and Estimating

GORDIAN

- Sam Giffin, Director, Data Operations

- Adam Raimond, Construction Index Manager

MORTENSON

- Jacob Eglseder, Director of Supply Chain

- Julianne Laue, Director of Building Performance

- Clark Taylor, Vice President Estimating

THE BECK GROUP

- Greg O’ Bryan, Senior Preconstruction Analytics Manager

Additional Resources

- https://www.reuters.com/markets/commodities/copper-study-group-expects-big-supply-surplus-2024-2023-10-06/

- https://www.reuters.com/markets/commodities/dwindling-copper-supply-panama-peru-could-wipe-out-global-surplus-2024-2023-11-28/

- https://www.gordian.com/resources/construction-data-insights-resources/

Share this: