Key Points:

- Overall Market Stability with Sector-Specific Volatility

While overall construction material costs remained stable in Q2 2024, certain materials experienced sharp fluctuations. For example, cold-rolled steel prices dropped significantly, while clay brick prices surged. This underscores the importance of adaptive procurement strategies and sector-specific cost monitoring. - Labor and Supply Chain Pressures Continue

Rising labor costs and skilled labor shortages are influencing material pricing and project timelines. Additionally, supply chain bottlenecks—especially in HVAC and electrical components like switchgear—are being driven by increased demand from AI and data center construction, leading to longer lead times and higher costs. - Data-Driven Forecasting for Strategic Planning

Gordian’s report, powered by RSMeans™ Data, emphasizes the value of data-driven cost modeling. Their composite cost model, based on nine common building types across North America, helps construction professionals make informed decisions in a rapidly evolving market.

Construction Cost Insights for Q2 2024

Every quarter, Gordian lends its expertise to the Construction Cost Insights Report. Produced in partnership with Building Design+Construction, the report features market observations and analysis from industry leaders, based on their experiences and Gordian’s RSMeans™ Data construction cost database. The industry standard for cost accuracy, RSMeans Data contains over 92,000 unit line items comprised of material, labor and equipment prices localized to 970+ locations. Available digitally and in print, this data is backed by more than 30,000 hours of research every year.

We recently published the latest Construction Cost Insights Report, covering Q2 of 2024. Here are four trends to watch as we head into the second half of the year.

Supply Chain Vulnerability

The construction material supply chain is strained. Unbroken, but on the brink, according to the experts lending their perspectives to the Q2 Construction Cost Insights Report. Gordian has been tracking the copper supply chain since the beginning of the year and the situation is precarious, as a Panamanian legal challenge to a major mining contract and a Peruvian miners strike have combined to slow the flow of copper supply. These production obstacles have arisen at a most inopportune time, as green energy initiatives projected to drive up copper demand are now in motion. These are hardly the only challenges to the global construction material supply chain.

Read more expert analysis of copper price trends in this blog post.

Geopolitical instability in Ukraine and the Middle East may further disrupt the supply chain. The same goes for drought conditions in the Panama Canal, which can currently accommodate smaller cargo ships only, resulting in longer lead times. Volatility in the oil market and the recent Port of Baltimore shutdown have also squeezed material supply. It is reasonable to wonder how much more stress the construction supply chain can handle before it snaps.

Construction Cost Stability

Construction material prices have been remarkably stable overall. That’s the good news. Now for the bad news. Specific sectors of the materials market experienced significant price shifts from Q1 to Q2. Prices for cold rolled steel products, including galvanized steel sheets and metal decking, have been on a wild ride for the last three years. That ride continued this quarter, as cold rolled steel prices dropped sharply across North America and upwards of 10% in some areas. Volatility in the steel sector is expected to continue.

Conversely, clay brick prices surged from Q1 to Q2 after more than six months of insignificant cost shifts. Gordian’s construction cost experts anticipate that high brick prices will likely sustain throughout the year. They may even increase.

After the price uncertainty of the pandemic years, the construction industry has enjoyed a period of equilibrium. That equilibrium may be quaking.

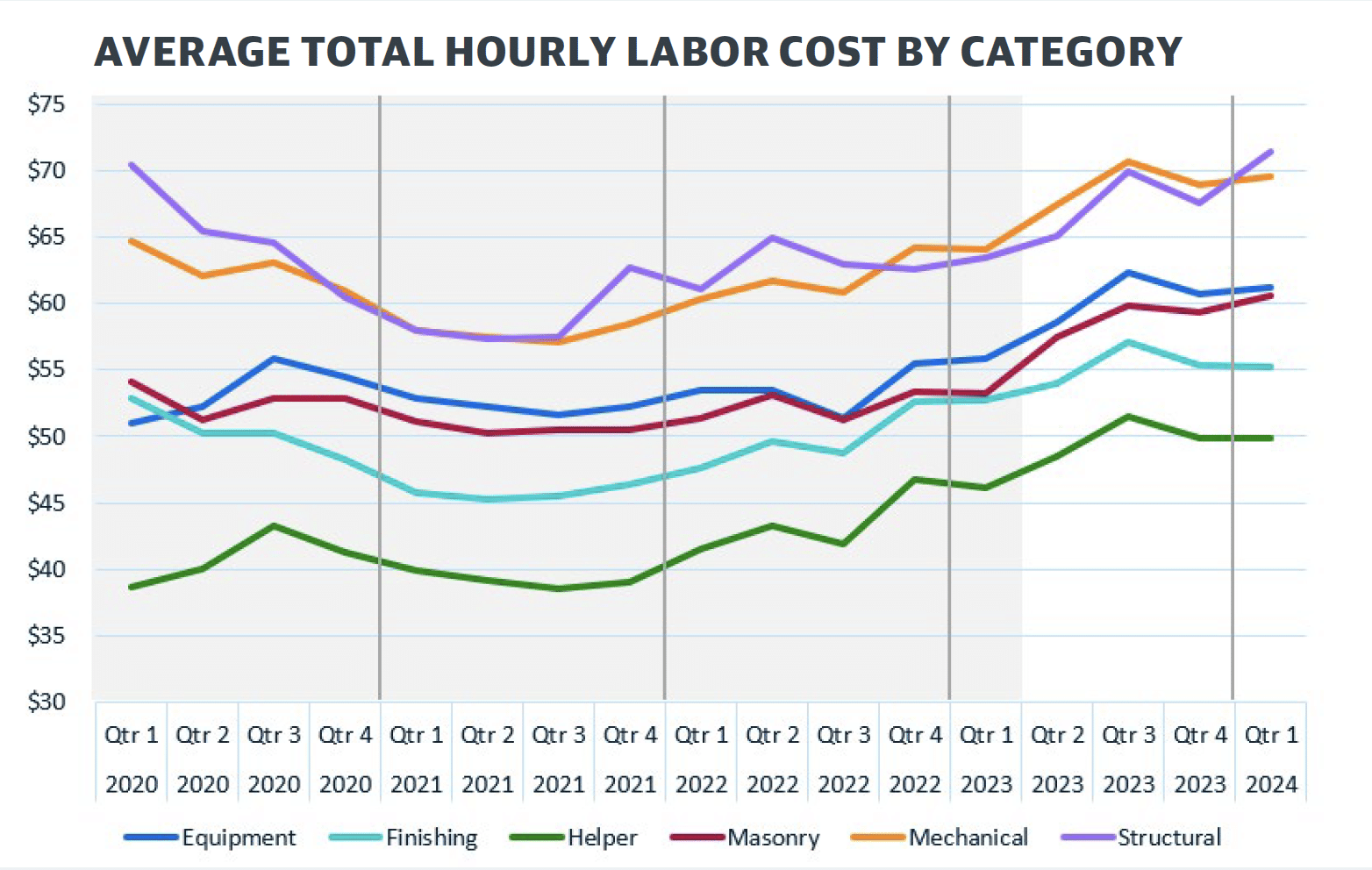

Looming Labor Wage Hikes

A litany of factors is contributing to a marked increase in construction labor costs. The first is a worker shortage. The supply of skilled labor is nowhere close to meeting the current demand. This dynamic has created a hyper-competitive environment intensified by sustained inflationary pressure and a significant injection of capital into public works projects via the Infrastructure Investment and Jobs Act (IIJA). Combined, this trio of market forces resulted in construction wages leaping an average of 20% from 2021 to 2023, per a January report from Gordian and ConstructConnect.

Average wage trade growth by trade, 2021 to 2023

More construction wage increases are likely to come, as the federal government has mandated Project Labor Agreements (PLAs) for all federally funded projects exceeding $35 million in contract value. PLAs have the potential to raise labor costs by 12%-20%. Considering this mandate impacts approximately 40% of the $34 billion federal construction budget, the market is bracing for a major impact to labor costs.

Further, the Department of Labor has overhauled the Davis-Bacon Act, reinstating the “3-step” calculation for prevailing wages after favoring a “2-step” calculation since 1983. Prevailing wage will now be calculated like this:

- The wage rate paid to a majority of workers in the classification, or

- If no majority exists, the rate paid to 30% of workers, or

- If no rate paid to at least 30% of that classification’s workers, then the weighted average in the classification.

With an estimated 1.2 million workers affected, the new calculation method is expected to elevate wages, particularly in regions with moderate-to-weak union presence, where collective bargaining agreements will exert greater influence.

Increasing Demand for Environmentally Friendly Materials

Construction industry norms are shifting toward environmental sustainability and eco-friendly practices. Hence, the emergence of mass timber. An engineered wood product manufactured through bonding and lamination, mass timber is robust and lightweight, a promising alternative competing with construction’s traditional powerhouses, steel and concrete. The product’s environmental benefits are impressive. Structures built with mass timber can reduce emissions from 13% to 26%. In addition to advancing sustainability, mass timber’s cost effectiveness makes it a potential game changer in the effort to go green.

Construction at a Crossroads

Uncertainty bubbles beneath the industry’s placid surface as we enter the second half of 2024. Construction costs are stable but show signs of volatility. The supply chain is manageable right now, but it may be on the verge of tectonic shifts. Increasing wages, while a boon for laborers, might put project owners in a bind. The industry is at a crossroads. The storm clouds currently overhead may dissipate and make way for sunny days. Or we may be in for a deluge of challenges. The forecast is currently in flux.

We’ll be back with more construction cost analysis and analysis in Q3. Until then, keep your eyes on these trends.